Olin Winchester, LLC

Olin Corporation completed the previously announced acquisition of the small caliber ammunition assets of AMMO, Inc. The assets, employees and ammunition business are now part of Olin's Winchester Ammunition business, including the brass shellcase capabilities and a newly constructed, world-class, 185,000ft2 production facility located in Manitowoc, Wisconsin. The facility and its skilled employees complement Winchester's existing production capabilities, enabling greater specialization and broader participation across a variety of high-margin, specialty calibers.

Funded from available liquidity, this transaction is expected to be immediately accretive to Olin's shareholders, delivering incremental expected first-year adjusted EBITDA of $10 to $15 million, including synergies realization, leveraging Winchester's industry-leading economies of scale, raw material sourcing, and our projectile, primer, and loading capabilities. Once fully integrated, this acquisition is expected to yield adjusted EBITDA of $40 million per year with full realization of synergies.

“During our recent Investor Day, we committed to our capital allocation framework,” says Olin's President and CEO, Ken Lane. “Like the White Flyer acquisition in 2023, this acquisition furthers our Winchester strategy to identify and secure small, bolt-on opportunities that are highly strategic and immediately accretive to Olin. By year three, we expect to have paid one and a half times adjusted EBITDA for these world-class assets.”

“The specialization of the Manitowoc facility will expand our reach into higher-value commercial, as well as international military and law enforcement calibers, while deepening our near full integration across the ammunition value chain,” says Brett Flaugher, President of Winchester Ammunition. “This shift enables our larger, legacy plants to focus on high-volume products and growing our cost advantage.”

This transaction represents a pivotal milestone in AMMO’s transformation into a high-margin, tech-enabled e-commerce company centered around GunBroker.com. The company intends to focus resources on scaling its digital platform, improving user experience, and unlocking additional value for shareholders.

“This transaction marks a defining moment in AMMO’s evolution,” says Christos Tsentas, Chair of the Board’s M&A Committee. “After a thorough strategic review and collaboration with our financial and legal advisors, we are confident this sale will unlock significant value and enable AMMO to accelerate growth as a pure-play e-commerce platform. GunBroker.com is already the leader in the online firearms marketplace, and we expect this streamlined focus will allow us to double down on innovation, user engagement, and long-term profitability.”

Positioned for scalable growth

GunBroker.com becomes AMMO’s remaining core business and a high-potential growth engine. Recent initiatives—including enhancements to the checkout experience and expanded offerings in outdoor gear and experiences—have led to improved customer engagement and conversion. The Company anticipates that a simplified business structure and a fortified balance sheet will further fuel targeted investments, operational efficiency, and disciplined capital allocation.

Rebranding and next phase

In conjunction with the sale, AMMO is beginning a formal rebranding process, including a corporate name change to Outdoor Holding Company, to better reflect its e-commerce identity and broader vision in the outdoor lifestyle and sporting goods sectors.

Latest from Defense and Munitions

- November 2025 U.S. cutting tool orders total $206.1 million

- Firehawk Aerospace expands U.S. rocket manufacturing with Mississippi facility acquisition

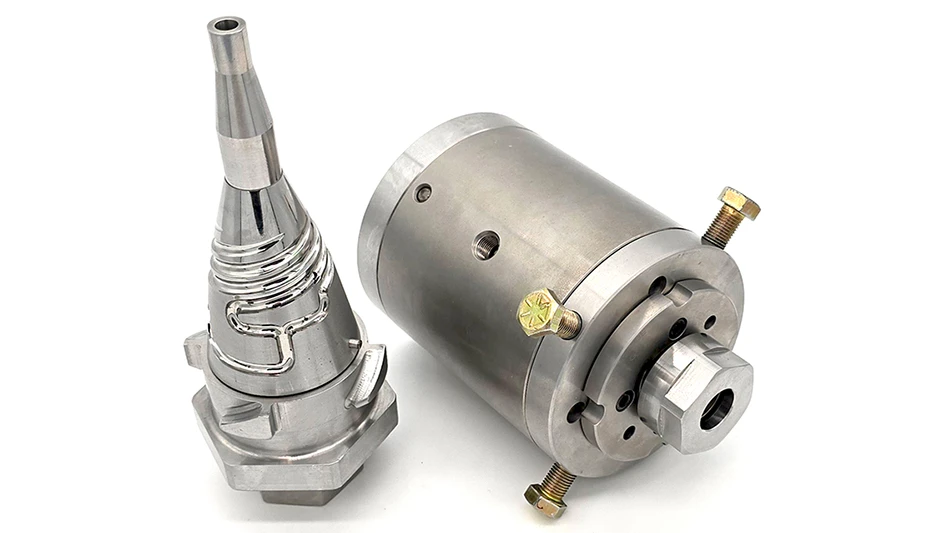

- Workholding Roundtable to feature expert insights on a booming market

- AV delivers JLTV-mounted LOCUST Laser Weapon Systems to U.S. Army

- James Tool Machine & Engineering, Inc. maintains As9100 Certification

- Sunnen Products Company's PGA-1000 Air Gage

- Xact Metal names Mark Barfoot VP – Global Sales

- REGO-FIX appoints Joshua Burnett Midwest Territory Sales Manager