Ajax/CECO?Erie Press

Reshoring is gaining momentum as shifting global economic conditions are forcing manufacturers to reevaluate their supply chains, and forging operations are squarely in the spotlight. Aerospace, defense, transportation, and heavy mobility are leading the charge, each relying on a steady flow of high-quality forged components to support growth, innovation, and national security.

At the same time, policy and pricing pressures are reshaping the competitive landscape. Tariffs on steel, aluminum, and other metals have raised the cost of imports, making domestic forging operations more competitive. In addition, Buy America provisions and other government trade measures are incentivizing companies to source domestically, to remain compliant with regulations and to reduce the uncertainty coming with fluctuating tariffs and duties on foreign goods.

The demand to reshore forging also reflects a fast-moving and unpredictable global environment where conflicts and rising tensions are requiring the U.S. to deepen its investment in military ordnance.

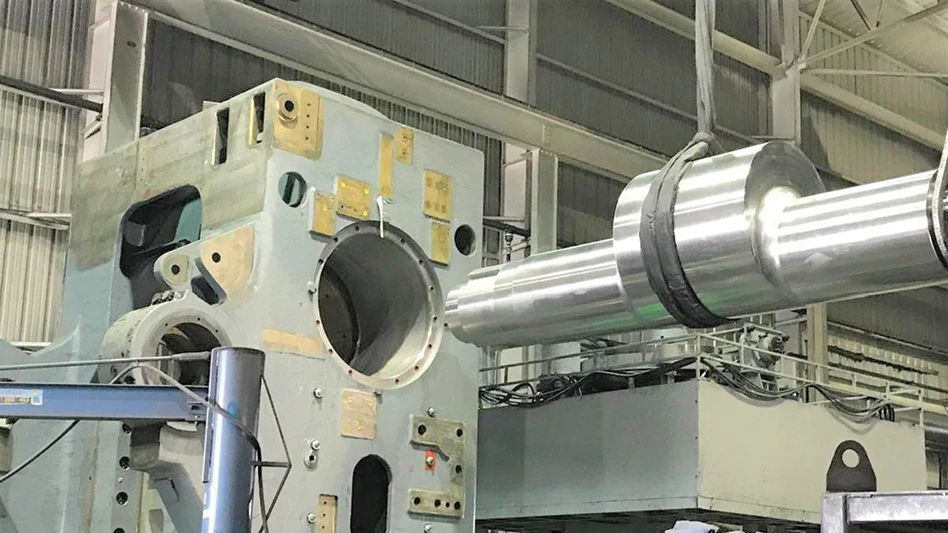

Forged components are found in virtually every defense implement, from rifle triggers to nuclear submarine drive shafts. Heavy tanks, missiles, armored personnel carriers, shells, and other heavy artillery require forged components.

Forging is also a core component for a multitude of parts including engine mounts, brackets, beams, shafts, landing gear cylinders, and struts and wheels in military aircraft and spacecraft.

With these pressures increasing demand, manufacturers are now facing longer lead times for new or custom forging presses and hammers. Fortunately, manufacturers have more than one path forward and investing in brand-new equipment is not the only solution.

Rebuilt forging equipment

Today, many forgers are turning to the revitalization of idle or underutilized machinery, commissioning complete rebuilds from original equipment manufacturers (OEMs). This approach allows production to scale up far more quickly while new forging equipment is still on order.

“Rebuilding is often the fastest, most economical means to get worn or mothballed equipment back into production when purchasing new equipment may not be feasible,” says Bill Goodwin, vice president of Sales, Ajax-CECO-Erie Press (ACE), the largest forging equipment supplier in North America, founded in 1875. The company has more than a century of experience in custom designing and building presses and forging machines spanning horizontal, vertical, mechanical, hammer, and hydraulic forging presses for a variety of applications.

According to Goodwin, rebuilding entails removing all of a machine’s parts and repairing or replacing them with OEM components to return them to manufacturer specifications. Recognizing the high-impact nature of forging takes its toll on parts over time, a rebuild typically includes replacing high-wear items such as bearings, bushings, seals, and liners and inspecting and repairing the frame.

Often more efficient and cost-effective than purchasing new forging equipment, rebuilding is ideal for quickly getting equipment operational again, often in as little as just a few months.

Rebuilding can even be an effective option for older forging equipment, including updates and modifications for new product lines or restoration to original specifications. A rebuild can also increase the production capacity of slow and inefficient equipment.

Optimizing the rebuild

When electing to rebuild, manufacturers can choose to contact the OEM to rebuild the equipment or contract with a third-party rebuilder. The decision is significant, given the need for a complete, dependable rebuild that will perform as expected for many years.

Rebuilders often use a reverse engineering process to create their parts or have them machined at local CNC shops. Although this approach may work in the short term to get equipment up and running, it ignores the long-term view. Even rebuilders with experience working on various other types of equipment, such as stamping presses or injecting molding machines, may only partially appreciate the forces exerted during the forging operation.

Moreover, critical engineering design data is lost when an independent rebuilder reverse-engineers a part, resulting in inferior part construction and premature wear or component failure.

“Often they are rebuilding a machine without truly understanding the original design intent or the loads that will be placed on the parts and equipment,” Goodwin says.

As an alternative, it can be advantageous to work with the OEM for an equipment rebuild. The OEM has the original design specifications, critical materials, and clearance specifications to jump on rebuilds and quickly finish the work.

A vast range of information is required for a quality rebuild, such as critical data on high-wear parts, the material grade of the steel, the heat-treating process utilized, and the required clearances used in that forger’s engineering.

When working with the OEM, a rebuild isn’t limited to restoring the original design capabilities to today’s standards but can also include significant automation upgrades.

“A rebuild can be approached in several ways,” Goodwin explains. “The forging equipment can be sent to us for rebuilding; we can send repair personnel to the manufacturer’s facility to rebuild equipment on-site, or we can supervise a rebuild by their maintenance staff.”

Whichever option a manufacturer selects, revitalizing old and unused forging equipment with an OEM can reclaim much needed capabilities from existing and dormant assets in a timely and cost-effective manner to meet increased demand for domestic forging capacity in the years to come.

Ajax-CECO-Erie Press (ACE)

Explore the January/February 2026 Issue

Check out more from this issue and find your next story to read.

Latest from Defense and Munitions

- HII places second Nikon SLM Solutions NXG 600E order

- L3Harris demonstrates interoperable network to unify Department of War and U.S. government agencies

- Platinum Tooling/Heimtec's speed increasers for lathes and Swiss-style machines

- U.S. Army awards Persistent Systems contract for $87.5 Million supporting Next-Generation Command and Control prototype

- Northrop Grumman successfully tests Mk 72 solid rocket motor for U.S. Navy

- Orqa announces Global Manufacturing Program to expand drone production to 1 million units annually

- Lantek's v.45 Suite software

- Kratos issues letter of intent for 60 full rate production Zeus hypersonic system rocket motors from L3Harris